Conway County Tax Collector Morrilton AR: A Comprehensive Guide

Are you looking for information about the Conway County Tax Collector in Morrilton, Arkansas? If so, you’ve come to the right place. This guide will provide you with a detailed overview of the tax collector’s office, its services, and how to interact with it effectively.

About the Conway County Tax Collector

The Conway County Tax Collector is responsible for collecting property taxes, motor vehicle taxes, and other taxes within Conway County. The office is located in Morrilton, the county seat, and serves as the central hub for tax collection and management in the area.

Location and Contact Information

Here’s the contact information for the Conway County Tax Collector:

| Address: | Conway County Courthouse 100 East Main Street Morrilton, AR 72110 |

|---|---|

| Phone: | (501) 968-3456 |

| Email: | [email protected] |

Services Offered

The Conway County Tax Collector offers a variety of services to help residents and businesses manage their tax obligations. Here are some of the key services provided:

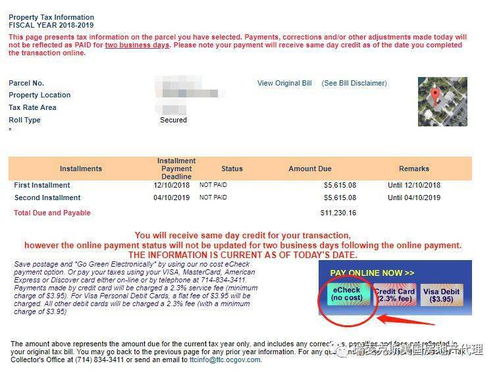

- Property Tax Collection: The office collects property taxes from homeowners and businesses within Conway County. This includes real estate taxes, personal property taxes, and other assessments.

- Motor Vehicle Tax Collection: The tax collector is responsible for collecting motor vehicle taxes, including registration fees and other related charges.

- Delinquent Tax Management: The office handles the collection of delinquent taxes, including the issuance of tax liens and the sale of tax liens at public auction.

- Payment Options: The tax collector accepts various payment methods, including cash, check, money order, and credit/debit cards.

- Property Tax Information: The office provides information on property tax assessments, tax rates, and other relevant data.

- Motor Vehicle Tax Information: The tax collector offers information on motor vehicle taxes, including registration fees, tax rates, and other related charges.

Property Tax Process

The property tax process in Conway County involves several steps:

- Assessment: The county assessor determines the value of your property and calculates the property tax based on the assessed value and the applicable tax rate.

- Bill Issuance: The tax collector sends out property tax bills to property owners, typically in July or August.

- Payment: Property owners have until December 31st to pay their property taxes. Failure to pay by this date may result in penalties and interest.

- Delinquent Tax Management: If taxes remain unpaid after December 31st, the tax collector may take action to collect the delinquent taxes, including the issuance of tax liens and the sale of tax liens at public auction.

Motor Vehicle Tax Process

The motor vehicle tax process in Conway County is similar to the property tax process:

- Registration: When you register a motor vehicle in Conway County, you must pay the motor vehicle tax, which includes the registration fee and the tax on the vehicle’s value.

- Renewal: Motor vehicle taxes are due when you renew your vehicle registration. Failure to pay the tax by the due date may result in penalties and interest.

- Delinquent Tax Management: If motor vehicle taxes remain unpaid, the tax collector may take action to collect the delinquent taxes, including the suspension of vehicle registration and the issuance of a tax lien.

How to Pay Taxes

There are several ways to pay your taxes to the Conway County Tax Collector:

- In Person: You