Understanding AR Model vs MA Model: A Comprehensive Guide

When it comes to time series analysis, two of the most commonly used models are the Autoregressive (AR) model and the Moving Average (MA) model. Both models are essential tools in the field of statistics and finance, helping analysts predict future values based on past data. In this article, we will delve into the details of these models, comparing their characteristics, applications, and limitations.

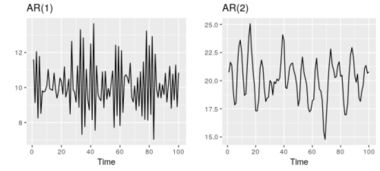

What is an AR Model?

An Autoregressive model, often referred to as an AR model, is a type of time series model that uses past values of a variable to predict its future values. The key idea behind an AR model is that the future value of a variable is a linear combination of its past values and a random error term. Mathematically, an AR model can be represented as:

| Yt | = | c + 蠁1Yt-1 + 蠁2Yt-2 + … + 蠁pYt-p + 蔚t |

|---|

In this equation, Yt represents the value of the variable at time t, c is the constant term, 蠁1 to 蠁p are the autoregressive coefficients, and 蔚t is the random error term. The order of the AR model, p, determines the number of past values used to predict the future value.

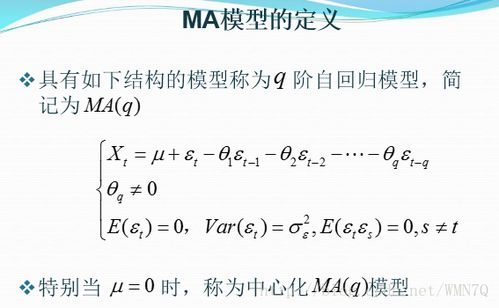

What is an MA Model?

A Moving Average (MA) model, on the other hand, is a type of time series model that uses past values of the error term to predict future values of the variable. The basic idea behind an MA model is that the future value of a variable is a linear combination of past error terms. Mathematically, an MA model can be represented as:

| Yt | = | c + 蔚t + 胃1蔚t-1 + 胃2蔚t-2 + … + 胃q蔚t-q |

|---|

In this equation, Yt represents the value of the variable at time t, c is the constant term, 蔚t is the random error term, and 胃1 to 胃q are the moving average coefficients. The order of the MA model, q, determines the number of past error terms used to predict the future value.

Comparison of AR Model vs MA Model

Now that we have a basic understanding of both AR and MA models, let’s compare them on various dimensions:

1. Structure

AR models focus on the relationship between past values of the variable and its future values, while MA models focus on the relationship between past error terms and future values. This difference in structure leads to different assumptions about the data and the underlying process.

2. Order

The order of an AR model, p, represents the number of past values used to predict the future value. Similarly, the order of an MA model, q, represents the number of past error terms used to predict the future value. The choice of order depends on the specific data and the underlying process.

3. Stationarity

Both AR and MA models assume that the data is stationary, meaning that the statistical properties of the data do not change over time. However, the process of making the data stationary may differ between AR and MA models.

4. Estimation

The estimation of AR and MA models can be done using various methods, such as the Yule-Walker equations, the Burg algorithm, and the Kalman filter. The choice of estimation method depends on the specific model and the available data.

5. Applications

AR models are commonly used in forecasting, signal processing, and econometrics. MA models are often used in filtering and smoothing