What is an AR Number?

An AR number, or Accounts Receivable number, is a unique identifier assigned to each customer’s account in a business. It is used to track and manage the financial transactions between the business and its customers. Understanding the importance and usage of an AR number can greatly enhance the efficiency of your accounting and customer relationship management processes.

How AR Numbers Work

When a business sells goods or services to a customer, an AR number is generated. This number is then used to record all transactions related to that customer, including sales, payments, and credits. The AR number is typically a combination of letters and numbers, and it is usually assigned in a sequential order to ensure uniqueness.

Importance of AR Numbers

AR numbers play a crucial role in several aspects of a business:

-

Tracking Customer Accounts: AR numbers help businesses keep track of their customers’ accounts, making it easier to manage and analyze financial data.

-

Streamlining Invoicing and Payments: By using AR numbers, businesses can create and send invoices to customers more efficiently, and customers can make payments using the assigned number.

-

Improving Cash Flow Management: AR numbers enable businesses to monitor their accounts receivable more effectively, which helps in managing cash flow and making timely collections.

-

Enhancing Customer Service: With AR numbers, businesses can provide better customer service by quickly accessing customer account information and resolving any issues that may arise.

Creating AR Numbers

Creating AR numbers can be done manually or through an accounting software system. Here are some steps to create AR numbers manually:

-

Decide on a numbering system: Choose a numbering system that suits your business needs, such as sequential numbers, alphabetic characters, or a combination of both.

-

Assign a unique prefix: Use a unique prefix for your AR numbers to identify the business or department responsible for the account.

-

Assign a unique suffix: Assign a unique suffix to each customer account to ensure that each number is unique.

-

Record the AR number: Once the AR number is created, record it in your accounting system or customer database.

Using AR Numbers in Accounting Software

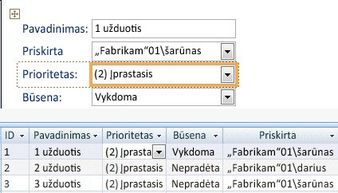

Accounting software systems often have built-in features to generate and manage AR numbers. Here are some common steps to use AR numbers in accounting software:

-

Set up the AR module: Configure the AR module in your accounting software to generate and manage AR numbers.

-

Enter customer information: Enter the customer’s details, including their name, contact information, and the assigned AR number.

-

Record transactions: Record sales, payments, and credits using the AR number to track the customer’s account.

-

Generate reports: Use the AR number to generate reports on customer accounts, sales, and collections.

Best Practices for Managing AR Numbers

Here are some best practices for managing AR numbers in your business:

-

Keep a record of AR numbers: Maintain a record of all AR numbers assigned to customers, including the date of creation and any changes made.

-

Regularly review AR numbers: Periodically review AR numbers to ensure they are accurate and up-to-date.

-

Train staff: Train your staff on the importance of AR numbers and how to use them effectively.

-

Use a centralized system: Use a centralized system to manage AR numbers, ensuring that all staff members have access to the most current information.

Table: Benefits of Using AR Numbers

| Benefit | Description |

|---|---|

| Improved Tracking | AR numbers make it easier to track customer accounts and financial transactions. |

| Streamlined Invo

|