SAP AR Aging Report: A Comprehensive Guide

Managing accounts receivable (AR) effectively is crucial for any business, and SAP’s AR Aging Report is a powerful tool that helps organizations keep track of their outstanding invoices. In this detailed guide, we will explore the various aspects of the SAP AR Aging Report, including its purpose, how to access it, and its key features.

Purpose of the SAP AR Aging Report

The primary purpose of the SAP AR Aging Report is to provide a clear and concise overview of a company’s outstanding invoices. By categorizing invoices based on their due dates, the report helps businesses identify which customers are late on their payments and how much is owed. This information is essential for financial planning, cash flow management, and maintaining healthy relationships with customers.

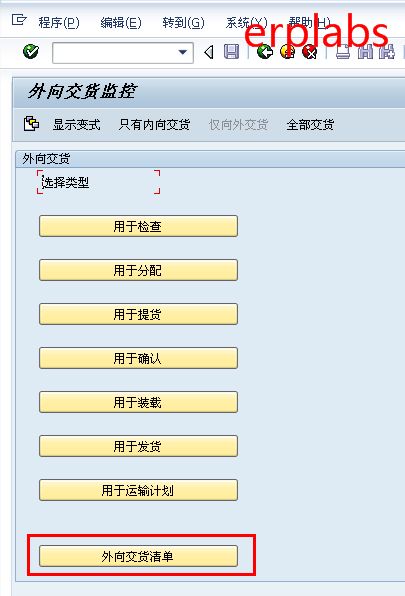

Accessing the SAP AR Aging Report

Accessing the SAP AR Aging Report is straightforward. Simply enter the transaction code “FBL1N” in the SAP transaction code field, and the report will be displayed. You can also access the report from the Financial Accounting (FI) module by navigating to “Financial Accounting & Controlling > Accounts Receivable > Reports > Aging Reports > Account Receivable Aging Report (FBL1N).” Once you have accessed the report, you can customize it to suit your specific needs.

Key Features of the SAP AR Aging Report

The SAP AR Aging Report offers several key features that make it an invaluable tool for managing accounts receivable:

- Customizable Aging Periods: You can set up aging periods based on your company’s specific requirements. For example, you may choose to categorize invoices into “Current,” “30 Days Past Due,” “60 Days Past Due,” and so on.

- Customer Segmentation: The report allows you to segment customers based on various criteria, such as customer group, sales organization, or division. This helps you identify which customer segments are most at risk of late payments.

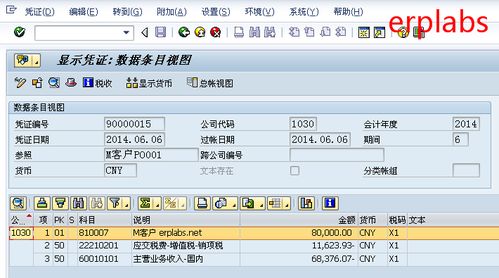

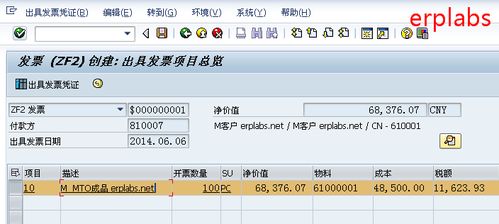

- Invoice Detail: The report provides detailed information about each invoice, including the invoice number, customer name, amount due, and due date. This makes it easy to track individual invoices and follow up with customers.

- Payment Schedules: You can view payment schedules for each customer, which helps you anticipate future cash flow and plan accordingly.

- Export and Print Options: The report can be exported to various formats, such as Excel or PDF, and printed for easy distribution.

Using the SAP AR Aging Report for Financial Planning

The SAP AR Aging Report is an essential tool for financial planning. By analyzing the report, you can identify trends in customer payment behavior and adjust your financial forecasts accordingly. For example, if you notice that a particular customer segment is consistently late on payments, you may need to adjust your credit terms or take other measures to mitigate the risk.

Improving Cash Flow with the SAP AR Aging Report

Effective cash flow management is critical for the survival and growth of any business. The SAP AR Aging Report can help you improve cash flow by:

- Identifying Late-Paying Customers: By highlighting customers who are late on their payments, you can prioritize your collections efforts and follow up with these customers promptly.

- Monitoring Payment Trends: Regularly reviewing the AR Aging Report allows you to monitor payment trends and adjust your collections strategy as needed.

- Implementing Early Payment Discounts: If you offer early payment discounts, the report can help you identify which customers are eligible for these discounts and encourage them to take advantage of them.

Enhancing Customer Relationships with the SAP AR Aging Report

Good customer relationships are the foundation of a successful business. The SAP AR Aging Report can help you enhance customer relationships by:

- Providing Clear Communication: By using the report to track and communicate payment status, you can ensure that customers are always aware of their outstanding invoices.

- Offering Assistance: If a customer is having difficulty paying an invoice, the report can help you identify the issue and offer appropriate solutions, such as payment plans or adjustments to the credit terms.

- Building Trust: By demonstrating your commitment to managing accounts receivable effectively, you can build trust